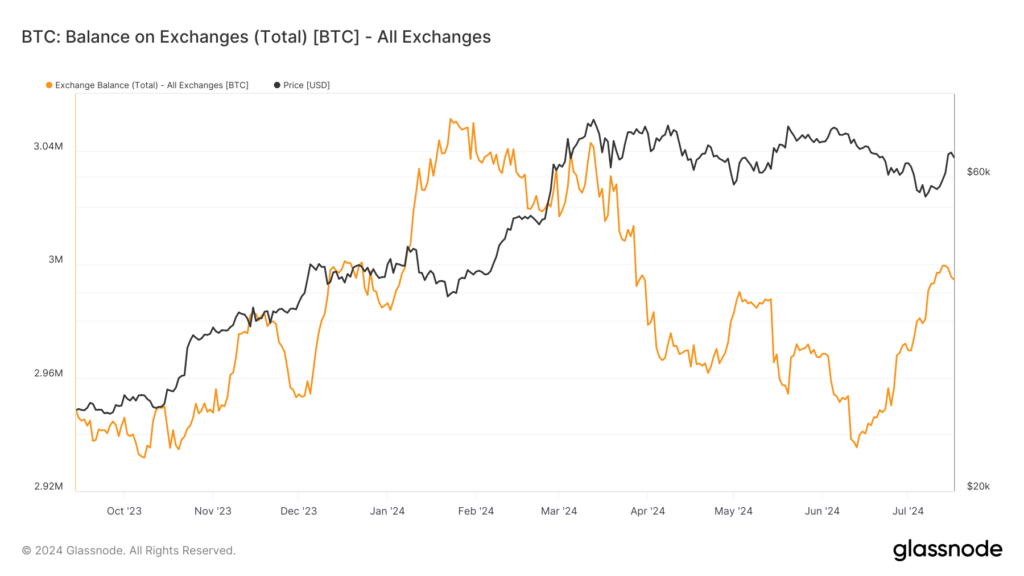

Bitcoin, currently valued at $64,900, has experienced significant movements in exchange balances over recent months, surging by 64,000 BTC, roughly $4.1 billion, in the last 30 days, according to Glassnode data. This follows a period of marked decline in exchange-held Bitcoin that began in early 2024 after the launch of the spot Bitcoin ETFs in the US and intensified post-halving in April 2024.

Bitcoin exchange balances (Glassnode)

Analyzing the chart, Bitcoin exchange balances increased throughout the end of 2023, peaking around late January 2024, coinciding with a local price low after the ‘sell the news‘ narrative of Bitcoin ETFs faded. This rise was likely driven by traders moving Bitcoin onto exchanges to capitalize on the price rally since October.

However, as prices fluctuated and peaked again around March and May 2024, there was a notable outflow of Bitcoin from exchanges, suggesting a shift towards holding assets in personal wallets as a long-term investment strategy.

The recent reversal, with significant inflows back to exchanges, suggests traders are selling into the slight market decline or taking advantage of the current price movements to reposition their holdings. This movement of Bitcoin onto exchanges can often precede increased trading activity, either for profit-taking or in anticipation of market shifts.

Since July 14, roughly 1,000 BTC have left exchanges in a recent slight reversal of the trend.

The post Exchange Bitcoin balances rise by $4.1 billion in last 30 days appeared first on CryptoSlate.